A key example of contra liabilities include discount on notes or bonds payable. Examples of contra accounts are accumulated depreciation in balance sheet and sales returns in income statement. Last, for contra revenue accounts there are sales discounts, sales allowances, or sales returns. These contra revenue accounts tend to have a debit balance and are used to calculate net sales. Contra revenue is a deduction from the gross revenue reported by a business, which results in net revenue.

- Past experience with uncollected bad debt has been, on average, 10% of credit sales.

- Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser.

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- Carbon Collective is the first online investment advisor 100% focused on solving climate change.

Contra revenue accounts reduce revenue accounts and have a debit balance. Contra asset accounts include allowance for doubtful accounts and accumulated depreciation. Contra asset accounts are recorded with a credit balance that decreases the balance of an asset.

Accounting for the Contrary

For example, the debit will be to the expense account in an estimated uncollectible amount from a credit sale. The credit will be to the asset account or allowance for doubtful accounts. Contra revenue accounts show the deducting adjustments to gross revenue or producing net revenue. Sales returned for a refund are posted to the contra What is a Contra Revenue Account — Example and Definition account to reduce gross revenue or return on sales. The other side of the transaction is posted to cash because there is no value in retaining the sales transaction in the cash account. Accounting contra asset accounts or contra revenue accounts follow a simple double-accounting procedure to eliminate errors in financial reporting.

- Thus, the term credit memorandum indicates that the seller has decreased the customer’s account and does not expect payment.

- Still, the dollar amounts are separately broken out in the supplementary sections most of the time for greater transparency in financial reporting.

- A general ledger is a comprehensive list of all accounts and their connected transactions in a business.

- A contra account is a general ledger account with a balance that is the opposite of another, related account that it is paired with.

- A contra revenue account is a revenue account that is expected to have a debit balance (instead of the usual credit balance).

- The sales discounts account contains the amount of sales discounts given to customers, which is usually a discount given in exchange for early payments by them.

The difference between an asset’s account balance and the contra account balance is known as the book value. In this way, an accumulated amortisation account offsets a related asset account (which is recorded as a debit). A contra account is used in order to better portray the relationship between certain debits and credits within the overall financial structure of an entity. A contra account can be used to remedy an error, to track depreciation of an asset, or to register payments that are not collectible. Overshooting in sales is caused due to overstating of sales returns and allowances. Credit memo numbers are records that allow your company to track credits given for various issues.

Presentation of Contra Revenue

If a cash refund is made due to a sales return or allowance, the sales returns and allowances account is debited and the cash account is credited. Put simply, contra accounts are used to reduce the normal accounts on the balance sheet. https://accounting-services.net/bookkeeping-raleigh/ If the related account has a debit as the natural balance, then the contra account will record a credit. Contra accounts are used to reduce the value of the original account directly to keep financial accounting records clean.

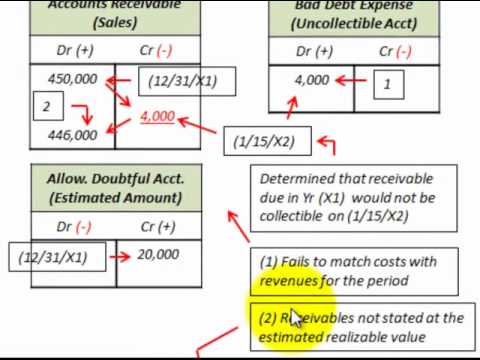

In order to balance the journal entry, a debit will be made to the bad debt expense for $4,000. Although the accounts receivable is not due in September, the company still has to report credit losses of $4,000 as bad debts expense in its income statement for the month. If accounts receivable is $40,000 and allowance for doubtful accounts is $4,000, the net book value reported on the balance sheet will be $36,000. When the amount recorded in the contra revenue accounts is subtracted from the amount of gross revenue, it equals the net revenue of a company.

Contra Account Examples

The percentage of sales method assumes that a fixed percentage of goods or services sold by a company cannot be received. For example, a building is acquired for $20,000, that $20,000 is recorded on the general ledger while the depreciation of the building is recorded separately. A contra account is a general ledger account with a balance that is the opposite of another, related account that it is paired with. To report the real value of the financial statement, you will need to record the amount you can reasonably estimate that will probably effect the financial statement classification. Contra accounts provide more detail to accounting figures and improve transparency in financial reporting.

Contra accounts are also used in other areas of the financial statements, such as an estimate on an uncontrollable percentage of credit sales in which the amounts listed must be estimable and probable. When this happens, the debit will be added to the expense account Bad Debt Expense and the credit will be added to the asset account, Allowance for Doubtful Accounts. The contra account definition in business accounting is an account used in the general ledger for the purpose of reducing the amount in another account related to it. A general ledger is a comprehensive list of all accounts and their connected transactions in a business. A contra account balances the numbers from two or more accounts that are compared on the balance sheet.

If we record those events within the relating account, we risk losing information that is relevant to analyzing performance. Accountants use contra accounts rather than reduce the value of the original account directly to keep financial accounting records clean. If a contra account is not used, it can be difficult to determine historical costs, which can make tax preparation more difficult and time-consuming. Again, the company’s management will see the original amount of sales, the sales discounts, and the resulting net sales.

When sales are returned by customers or an allowance is granted to them due to delayed delivery, breakage, or quality issues, an entry is made in the sales returns and allowances journal. They are useful in preserving the historical value in the main account while presenting a write-down or decrease in a separate contra account that nets to the current book value. Contra accounts serve an invaluable function in financial reporting that enhances transparency in accounting books.

Learn about the meaning of contra accounts, how and why they are used, and how to account for balances with them. The purpose of a contra account is to accurately report value of operating performance and assets for a firm. A contra account is an account that records events like adjustments and transactions that are having an opposite effect on a relating account’s true value on the firm’s financial statements.

- A contra account is where we record events that are contrary to a general ledger parent account, also called a relating account.

- The normal balance of a contra account, and the debit or credit, will be the opposite of the entry and normal balance in the parent account.

- In the seller’s books, a return or allowance is recorded as a reduction in sales revenue.

Contra equity reduces the total number of outstanding shares on the balance sheet. The key example of a contra equity account is Treasury stock, which represents the amount paid to buyback stock. This type of account could be called the allowance for doubtful accounts or bad debt reserve. The balance in the allowance for doubtful accounts represents the dollar amount of the current accounts receivable balance that is expected to be uncollectible. The amount is reported on the balance sheet in the asset section immediately below accounts receivable.

How to Record a Contra Account

The use of contra accounts ensures the accuracy of financial accounting records, as the value of the original accounts is not directly reduced. In the event that a contra account is not utilized, it can become increasingly troublesome to determine historical costs, which makes tax preparation time-consuming and difficult. Whereas assets normally have positive debit balances, contra assets, though still reported along with other assets, have an opposite type of natural balance. Contra liability accounts such as discount on bonds payable and discount on notes payable usually carry debit balances.